About

I am not like other financial folks.

I’ve always been more of a people person with a fascination for business. Everywhere I go I talk to business owners about what they do and how they do it. What do they attribute their success to? What keeps them up at night?

I got my love of business from my father, Norman Margolies, the ultimate entrepreneur. He opened his first business in 1954, a tiny sliver of a restaurant in the Bedford Stuyvesant section of Brooklyn. I went by the building on a recent trip to New York and was truly humbled by the small space. It was the beginning of a very successful chain of restaurants my father would eventually own through the 1960s.

But I happen to be blessed with a gift for numbers. I got this talent from my mother, Irene, who was a bookkeeper and taught me that “Numbers Don’t Lie”. Early on in my professional life I figured out that I could combine my love of business with my gift for numbers. After I received my Bachelor of Arts from Brandeis University, I moved to Atlanta and began working as a bookkeeper for small businesses. I quickly realized that I could seriously increase my earning power and skills by becoming a Certified Public Accountant. I attended Georgia State University in the evenings while working a full-time job in the accounting department of a local bank. I then earned my CPA license while working for Arthur Andersen in both the audit and tax departments.

In 1987 I founded my own CPA firm and spent the next 21 years working directly with business owners. I built a solid CPA practice which I sold for top dollar in 2008. I have advised hundreds of companies, from startup through liquidation. I have worked with micro businesses, sole proprietorships, and multi-million dollar companies. I’ve learned first hand that the more deeply a business owner understands the financial reality of his business, the more confident and decisive he is, and the more enjoyable and lucrative his experience.

I have extensive experience with foreign held U.S. companies as well as U.S. companies conducting business around the globe.

During the years of running my firm I managed to meet every tax deadline as well as chaperone field trips, cheer at Lacrosse matches and travel at every opportunity.

Since selling my practice I have written a book, The Complete Idiot’s Guide To Low-Cost Startups. I do keynotes and workshops on what it takes to succeed as an entrepreneur and how to use the power of Financial Visibility (read more below ![]() ) at varying stages of the business lifecycle. I teach entrepreneurship and finance courses at Emory University’s Continuing Education department. I use my financial expertise to advise independent business owners, and teach them my Financial Visibility System to improve cash flow, identifying areas of potential growth, create a written vision for their Company’s future, how to strategize to reach their goals and provide them tools to monitor and measure their progress.

) at varying stages of the business lifecycle. I teach entrepreneurship and finance courses at Emory University’s Continuing Education department. I use my financial expertise to advise independent business owners, and teach them my Financial Visibility System to improve cash flow, identifying areas of potential growth, create a written vision for their Company’s future, how to strategize to reach their goals and provide them tools to monitor and measure their progress.

To learn more about how you can hire me to help you be more successful, click on one of the boxes in the right hand column of this page, based on where your company is in the business lifecycle.

I believe that owning your own business can be an American dream come true, if it is built on a solid Financial Visibility System.

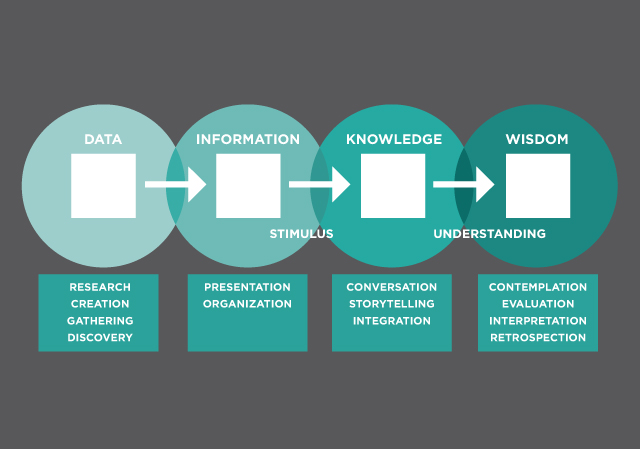

What is ![]() Financial Visibility? It is using the data you already have in your accounting system to achieve absolute clarity about what is driving the successes of your business. It’s also about seeing what really isn’t working for you. While advising hundreds of business owners over 30 years I had the opportunity to observe first hand what really makes the difference between businesses that are enormously successful and those that merely survive. I know that owners who have a thorough understanding of their company’s performance, based on their financial results, are better decision makers, more forward thinking, more innovative and ultimately make much more money than their counterparts who rely solely on intuition and hard work.

Financial Visibility? It is using the data you already have in your accounting system to achieve absolute clarity about what is driving the successes of your business. It’s also about seeing what really isn’t working for you. While advising hundreds of business owners over 30 years I had the opportunity to observe first hand what really makes the difference between businesses that are enormously successful and those that merely survive. I know that owners who have a thorough understanding of their company’s performance, based on their financial results, are better decision makers, more forward thinking, more innovative and ultimately make much more money than their counterparts who rely solely on intuition and hard work.

The clarity achieved through Financial Visibility requires a multi-faceted approach to a business’ finances. You must go far beyond the traditional reporting that most business owners rely on (or shove into a file drawer, never again to see the light of day). Although you can gain some insights from looking at a two year comparative Profit and Loss Statement, there is so much more to be understood about your business. Financial Visibility means knowing who your top customers are, which of your products or services are your top sellers and by how much, and how you are going to meet your near and mid-term financial obligations.

Financial Visibility empowers the CEO of any size company to lead as confidently as a Fortune 500 executive. It’s about having the critical numbers in front of you, currently updated to highlight any new trends, positive or negative. A Company can only be nimble in reacting to change when it sees the change coming.

I’ve saved the best part for last. Financial Visibility is not based on complicated formulas. Everything you need to turn your data into valuable knowledge you learned by the Fourth Grade. It’s simple Arithmetic. To learn more about how I can help you achieve the Financial Visibility you deserve, click on one of the boxes in the right hand column of this page, based on where your company is in the business lifecycle.

Who Gail Works With

Emerging Independent Business Owners

Retailers/Pet Care/IT Sales and Services

You have begun your startup journey in earnest and want guidance to launch successfully.

Expanding Independent Business Owners

Creatives/E-Commerce/Global Marketers

You are moving beyond breakeven and want to confidently choose the right path for

sustainable growth and profitability.

Established Independent Business Owners

Personal Services/Food Service/Professional(knowledge) Services

You are poised to build on your existing success, step into a true leadership role, focus on strategic activities and reduce time spent on operational tasks.

Exiting Independent Business Owners

Manufacturers/Real Estate/Home Furnishings

You are ready to reap the fruits of your hard work and realize your Ultimate Profitable Outcome – the sale of your company.